When deciding between a Texas title loan and a personal loan, consider their distinct characteristics: secured vs unsecured, risk levels, interest rates, approval processes, and potential risks like repossession. Texas title loans offer faster approval and flexible terms but carry vehicle repossession risk and high rates. Personal loans lack collateral, provide lower rates, simpler applications, diverse repayment options, and shield borrowers from repossession threats, making them a safer choice for urgent needs despite potentially longer approval times.

When considering a loan, understanding the difference between secured and unsecured options is crucial. This article delves into the dynamics of Texas title loans and personal loans, both prominent financial instruments in today’s digital era. We explore the pros and cons of each, focusing on their unique features and benefits. By comparing these two options, specifically highlighting a Texas title loan vs personal loan, borrowers can make informed decisions tailored to their needs.

- Understanding Secured and Unsecured Loans

- Texas Title Loan: Pros and Cons

- Personal Loan: Features and Benefits Compared

Understanding Secured and Unsecured Loans

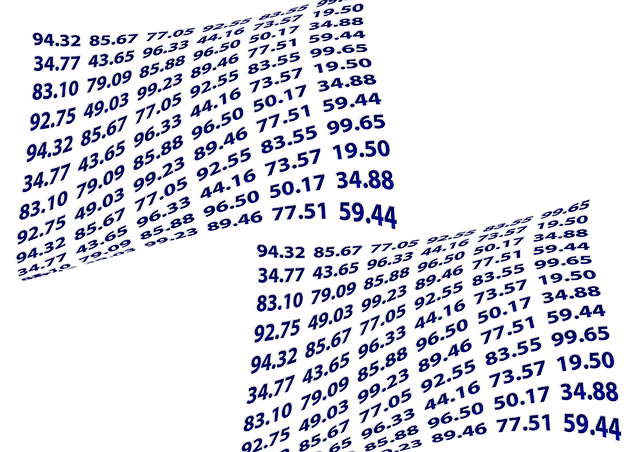

Loans can be categorized into two main types: secured and unsecured. When considering a Texas title loan vs personal loan, understanding this distinction is crucial for making an informed decision. Secured loans are backed by some form of collateral, typically a valuable asset like your vehicle. In the case of a Texas title loan, your vehicle serves as security, ensuring the lender has something to recover if you fail to repay the loan. This type of loan often offers lower interest rates and more flexible repayment terms since the lender is at reduced risk.

On the other hand, unsecured loans do not require any collateral. Personal loans fall into this category. Lenders rely solely on your creditworthiness and ability to repay when offering these loans. While they might come with higher interest rates, there’s no risk of losing an asset if you default. The process for obtaining a personal loan is usually simpler, involving less red tape compared to securing a Texas title loan, which requires a thorough vehicle inspection to assess its equity. Keep your vehicle while enjoying the convenience and accessibility of unsecured lending options.

Texas Title Loan: Pros and Cons

In Texas, a Texas title loan offers a unique financing option for individuals with a hidden asset—their vehicle. This type of loan is specifically secured by the car’s title, making it an attractive choice for borrowers who need quick cash and have a reliable vehicle. One significant advantage is that approval processes are often faster compared to personal loans, as the lender prioritizes the value of the collateral rather than complex credit checks. This can be advantageous for those with less-than-perfect credit or no credit history. Additionally, car title loans typically provide more flexible loan terms and customizable repayment plans, allowing borrowers to tailor payments to their budgets.

However, there are potential drawbacks to consider. If the borrower defaults on payments, they risk losing their vehicle through repossession. Unlike personal loans with various borrowing limits, Texas title loans generally have stricter maximum amounts based on the car’s value, which might limit the funds available. Moreover, interest rates for these loans can be higher, and borrowers should be prepared for potential hidden fees. While flexible payments are a plus, it’s essential to understand the loan terms thoroughly to avoid being trapped in a cycle of debt.

Personal Loan: Features and Benefits Compared

Personal loans offer a flexible financing option for various purposes, from home improvements to debt consolidation. One significant advantage is the wide range of repayment options available, allowing borrowers to choose terms that align with their financial capabilities. This flexibility makes personal loans an attractive alternative to Texas title loans for those seeking quick cash. Unlike Houston title loans, personal loans do not require collateral, reducing the risk and potential loss for borrowers.

Additionally, personal loans typically have lower interest rates compared to cash advances or short-term title loans. Lenders consider the borrower’s creditworthiness and offer competitive rates, making it a more cost-effective choice. The process of securing a personal loan is generally straightforward, with online applications and faster approval times, catering to urgent financial needs without the hassle often associated with traditional banking processes.

When considering a Texas title loan vs personal loan, understanding the distinctions between secured and unsecured lending is key. While a Texas title loan offers benefits like faster approval times, it requires the use of your vehicle as collateral, presenting potential risks if you’re unable to repay. In contrast, a personal loan is an unsecured option with broader accessibility, making it a safer choice for borrowers without assets to pledge. Ultimately, the best decision depends on your financial situation and risk tolerance, ensuring you choose the lending path that aligns with your needs.